This briefing note is part of a series on COVID-19 and its impact on the retail trade industry. This piece focuses on the link between retail trade and tourism. Examining retail and tourism together allows us to compare the impacts of the pandemic on these sectors and assess their immediate needs. Other briefing notes in this series focus on the impact of the pandemic on retail from a national and provincial perspective, retail trade employees, and what a post-pandemic reality might look like for Niagara’s retail trade industry.

In response to the COVID-19 pandemic, governments in Canada enacted a series of supports, recommendations, and by-laws to slow the spread of COVID-19. Though these supports and mandates helped slow the virus’ spread, they also impacted businesses and employment. Given the prevalence of tourism in the Niagara region, stay-at-home orders and border closures have had a significant impact on the local economy.

Tourism and Retail Trade

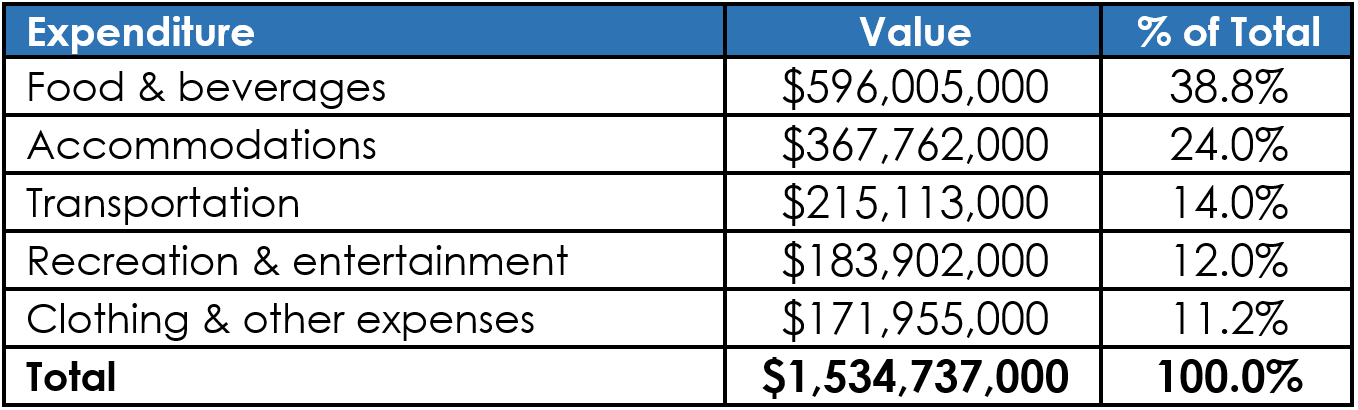

A 2018 report on Niagara’s Tourism Profile found that 2.4% of visitors to the region (316,000 visitors) travelled specifically for shopping.[1] Those who did not travel specifically to shop still spent significant amounts of money within the retail trade sector. Specifically, 38.8% of visitor expenses from Canadian tourists[2] travelling to Niagara were spent on food and beverage expenses and 11.2% were spent on clothing and other expenses.[3] Complete data on money spent by tourism activity are presented in Table 1.

Table 1. Money spent by expenditure type, Canadian visitors to Niagara, 2017

Municipalities across Niagara have noted the intersection of retail trade and tourism in their local action plans. For example, the Town of Lincoln’s Tourism Strategy and Action Plan 2020-2025 recommended developing a tourism friendly downtown through the “concentration of tourism retail.”[4] This was suggested because “successful small-town destinations provide visitors with…appealing tourist retail and dining [experiences].”[5] In Niagara, examples of the intersection between retail trade, dining, and tourism include specialty food shops, artisan galleries at wineries, and restaurants that include specialty grocery sales.

Tourism Jobs and Employment

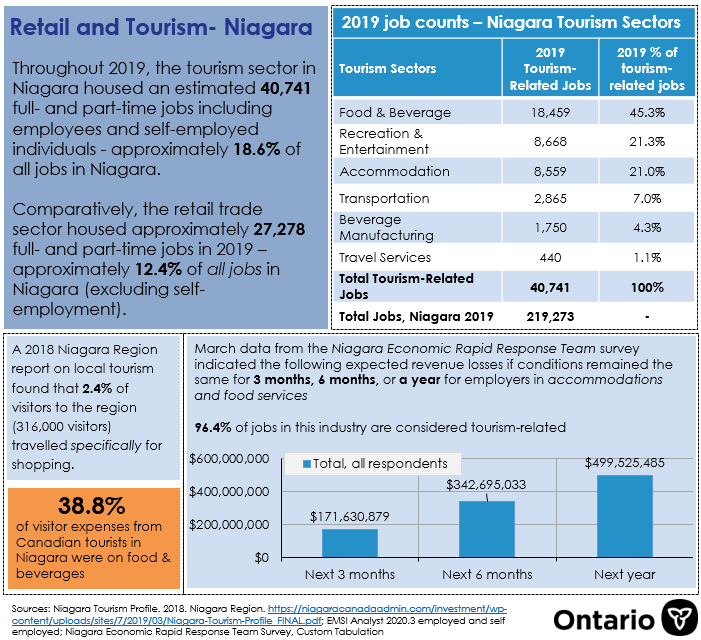

Throughout 2019, the tourism sector in Niagara housed an estimated 40,741 full- and part-time jobs including employees and self-employed individuals (see Table 2). These tourism-related jobs represented approximately 18.6% of all jobs in Niagara. Comparatively, the retail trade sector housed approximately 27,278 full- and part-time jobs in 2019 – approximately 12.4% of all jobs in Niagara (excluding self-employment).

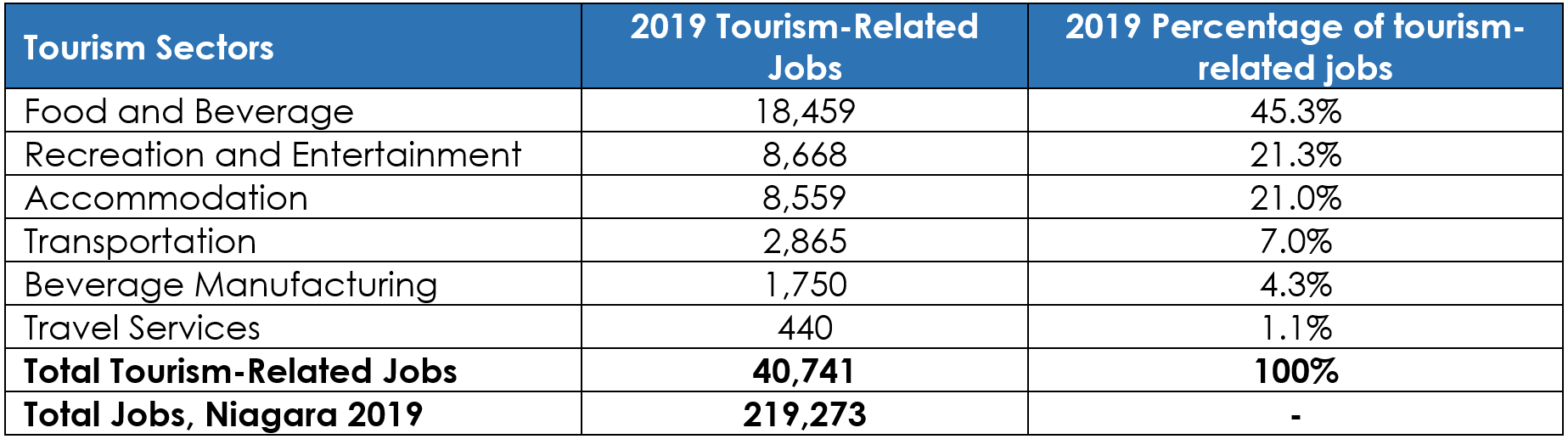

Table 2. 2019 job counts in Niagara’s tourism sectors

A Statistics Canada framework for measuring tourism identified the sectors in Table 2 as essential to tourism. This is because any major reductions to tourism would significantly impact the revenues of these sectors. While an exact number of jobs lost to tourism due to COVID-19 is not available, we can estimate the potential impacts locally. Pairing current employment trends and 2019 job count data, NWPB estimates that Niagara saw an estimated 16,327 people lose employment in tourism. This would be a decrease of 42.3% in tourism-related employment between February and July 2020.[6]

This decrease is particularly troubling as it comes at a time when tourism is usually at its peak in Niagara. Within Niagara, the wholesale and retail trade industry saw similar employment losses throughout COVID-19. Specifically, from February through July, the wholesale and retail trade sector saw an overall decrease of 7,200 people employed, or 22.3% of total employment prior to the pandemic.

Table 3. Niagara residents reporting employment in tourism sectors, February-July 2020

Retail and Tourism Businesses

Data from the Niagara Economic Rapid Response Team (NERRT) also provide insights on the impact of COVID-19 on local tourism businesses.[7] The current report outlines data from respondents in the accommodation and food services industry. Though this industry does not represent every tourism-related business in Niagara, 66.3% of all tourism-related jobs can be found within the accommodation and food services sector. Moreover, within this sector, 96.4% of jobs are considered tourism-related.

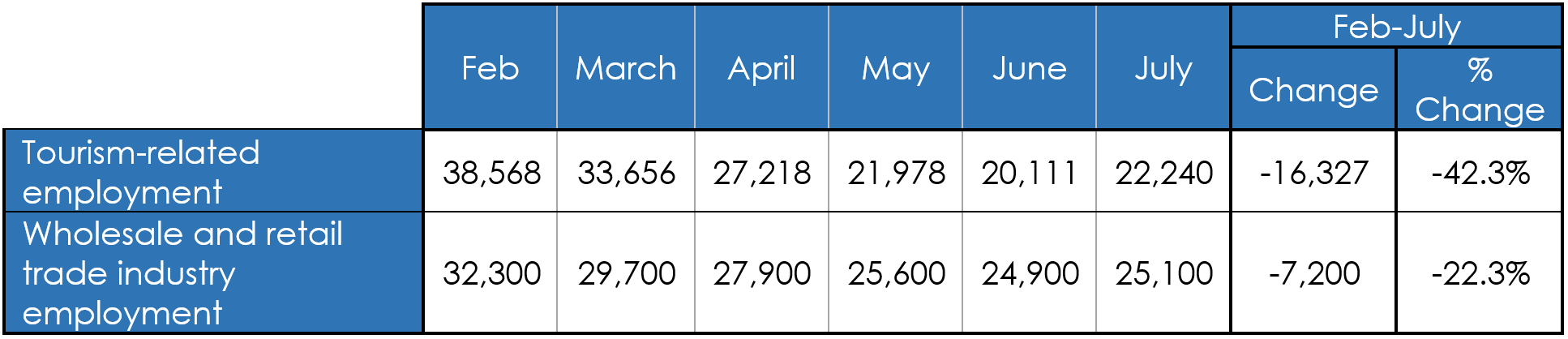

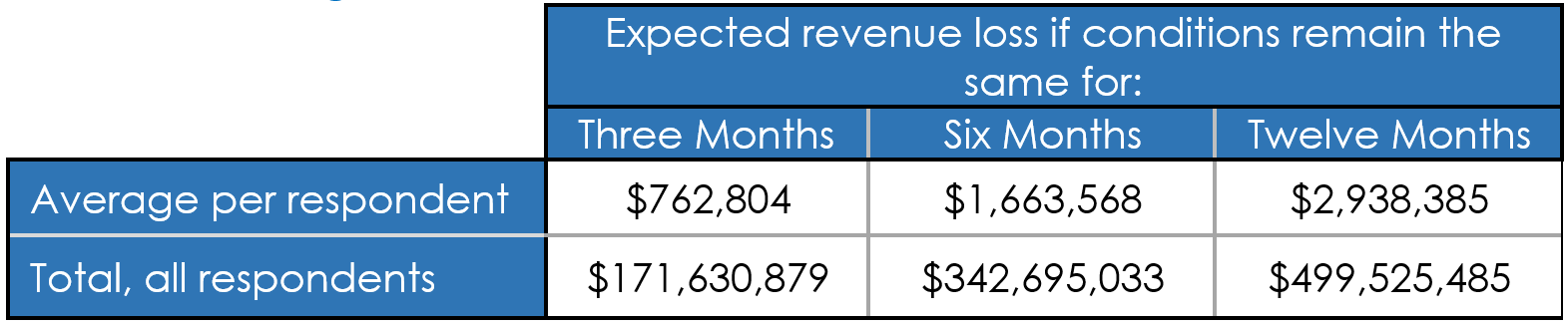

Data from the NERRT’s survey show that by the end of March, 63.2% of Niagara employers in accommodation and food services had already reported 76%-100% reductions in staff. Moreover, survey respondents from the accommodation and food services industry noted that if current conditions continued for six months, they expected revenue loss of $342.7 million (see Table 4).

Table 4. Expected revenue loss due to COVID-19 for accommodation and food services businesses, Niagara

Tourism and tourism-adjacent businesses have had to adjust to restricted in-person customer conditions and lowered economic activity during what would typically be their high season. As such, data from the NERRT survey further showed that accommodation and food services respondents were focused on the slow return of customers (54.0% of respondents), and cash flow and increased debt loads (39.8%). Similar trends were found from employers in retail with their main concerns also being slow return of customers (44.2%) and cash flow/increased debt (30.4%) again showing how these related sectors are experiencing similar difficulties in the wake of the pandemic.

As a result of these economic challenges, we are beginning to hear anecdotal evidence that some of these businesses will be forced to close through their traditional “off-season” due to a lack of funds. Given the close link between tourism and retail trade, the spillover effect into Niagara’s retail trade sector will be monitored moving forward. These data present difficult realities for employers and employees working in Niagara’s tourism and retail trade-related sectors.

[1] Niagara Tourism Profile. 2018. Niagara Region. https://niagaracanadaadmin.com/investment/wp-content/uploads/sites/7/2019/03/Niagara-Tourism-Profile_FINAL.pdf

[2] Data regarding expenditure type were only available for visitors from within Canada.

[3] Ibid.

[4] Town of Lincoln Tourism Strategy and Action Plan, 2020-2025. 2020. Office of the Chief Administrative Officer. https://lincoln.civicweb.net/document/109217

[5] Ibid.

[6] We stress that this number is an estimate of tourism-related employment numbers and job loss and should not be used as a definitive statement on the change in tourism-related employment during the pandemic. We are using two separate datasets to estimate these job loss figures and these numbers are approximations of job loss in this sector, rather than ironclad figure.

[7] These data are derived from the Niagara COVID-19 Business Impact Survey, delivered by the Niagara Economic Rapid Response Team. NWPB gratefully acknowledges the efforts of Niagara’s twelve municipalities and the Regional Municipality of Niagara in delivering this survey.